Argo C++ Trading API

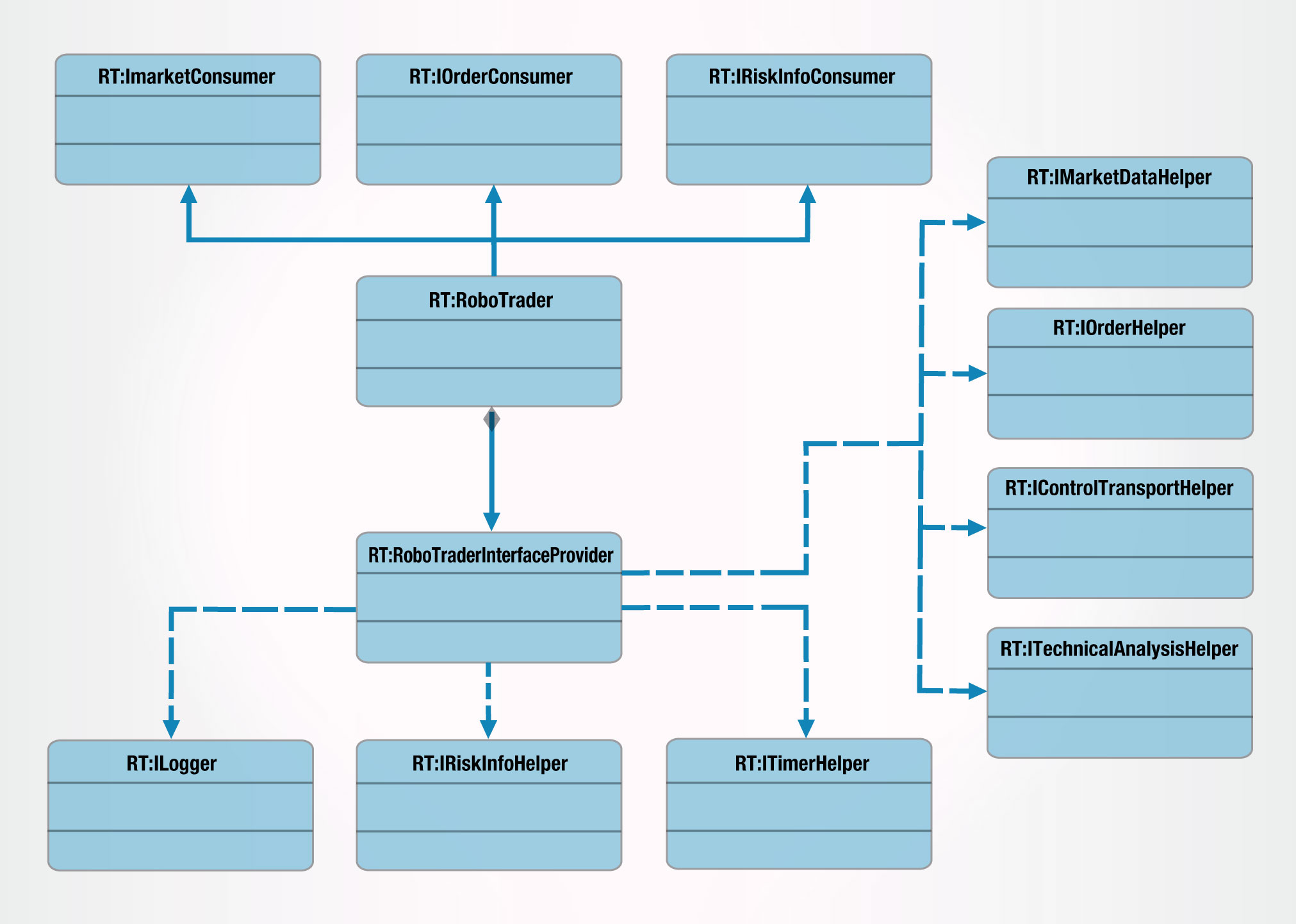

Argo Trading API is a tool of algorithmic trading, high-frequency trading specialists and trading front-end application developers. API provides order and quote management, market data, risk information and technical analysis interfaces. Click on the class diagram to get more details, or see complete API reference.

API-based algorithmic trading strategy runs on the server side. It is seamlessly integrated with ATP Order Management System, Market Data Distribution facility, Risk Management System and (optionally) reports its state to ArgoTrader front-end.

Argo Web API

Argo Web API is built as a set of RESTful request/reply and WebSocket data streaming services. It can be divided into three sub-domains: order management, market data and risk information. An authorization (logon) procedure is required before any Trading API calls can be made. Typically, Web API returns data in xml format. Requests are HTTP Get and Post messages. Some requests contain JSON formatted objects.

Read documentation for Argo Web API’s:

Argo High-Frequency Trading Solution (HFT)

Argo HFT integrates Trading API, ultra-fast Order Management System and Market Data Distribution facility with in-process trading venue order management and market data adapters. The solution comes in one lightweight Linux package with network interface cards by Solarflare and OpenOnload kernel-bypass IP stack.

Backtesting and Forward Testing

Backtesting allows an automatic strategy developer to verify his algorithms implemented in API-based application (robot) without sending orders to live markets.

ATP Backtesting Workflow:

- Collect market data

- Configure API-based algorithmic trading application to run in market simulation mode

- Insure output of strategy performance metrics, P&L

- Run API-based program(robot) in simulation mode

- Analyze performance metrics, adjust algorithm, repeat

ATP Forward Testing:

Traders often make the mistake of relying entirely on backtesting results to determine whether the system will be profitable. While backtesting provides traders with valuable information it is only one part of the evaluation process.

Forward performance testing, also known as paper trading, is a simulation of actual trading and involves following the system’s logic in a live market. All trades are executed on ATP Matching Engine that runs in market simulation mode, no orders are sent to real markets. Argo Matching converting market data coming from the exchange into buy and sell limit orders that are posted into its own Order Book. Client orders are matched against simulated contra orders. Simulation logic adjusts simulated orders quantities on each price level as necessary, submitting new orders and/or canceling existing ones based on new market depth updates coming from the exchange.

Argo Trading Platform Source Code Licenses

You can purchase ATP source code by paying a one-time license fee and distribute the application to your clients without paying additional fees. We offer distributable licenses for software developers and brokers.

Buying Argo Trading Platform can save you several man-years of in-house development.

Our source code licenses may cost you less than binary executables from our competitors.

We also provide free white labeling.

To evaluate our Trading Platform please send us a request and provide contact information. We will get back to you shortly.

Request a Demo

Send us a message using a form below, or call +1 847.520.2199 for details.